when will the housing market go down in utah

My top 14 housing market predictions for 2022 are. The unemployment rate will stay low.

Real Estate Housing Market Crash Housing Bubble Factors Signals Predictions

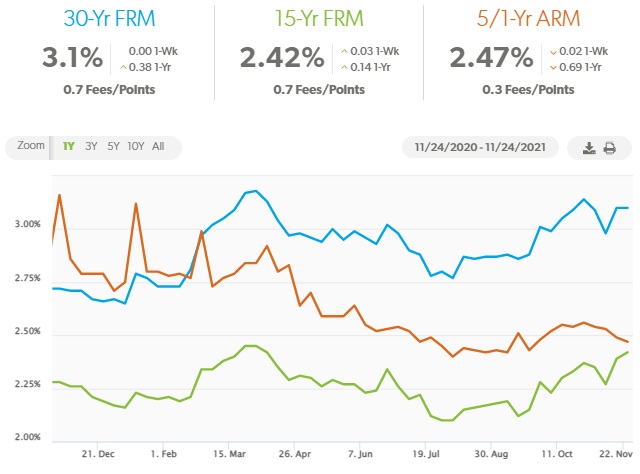

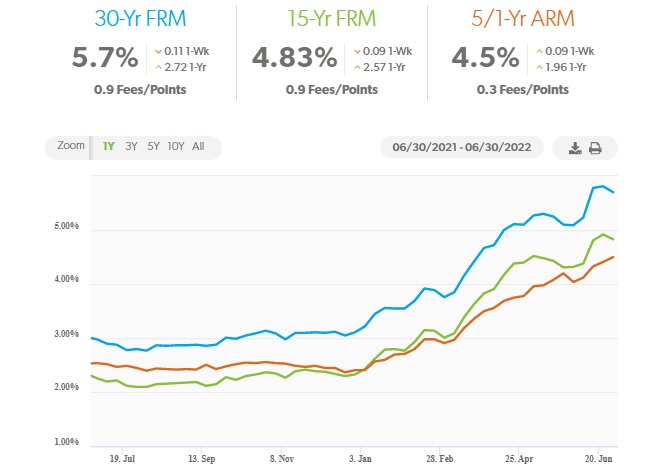

Interest rates go up and they come down.

. Job openings will continue to be over 10 million. These protections are scheduled to lapse at the end of June. In 2008-2011 the price of homes in SLC dropped by 20 according to Niche Homes.

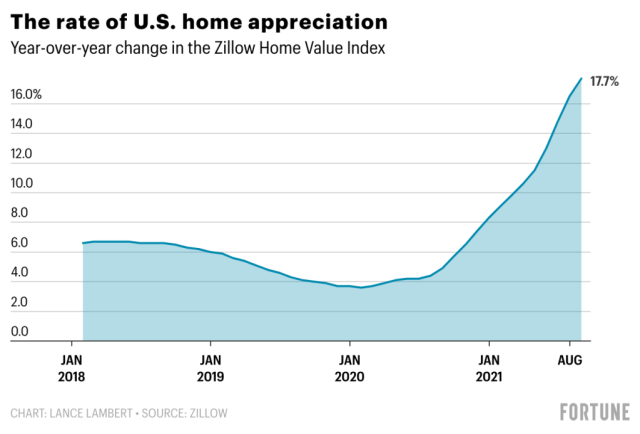

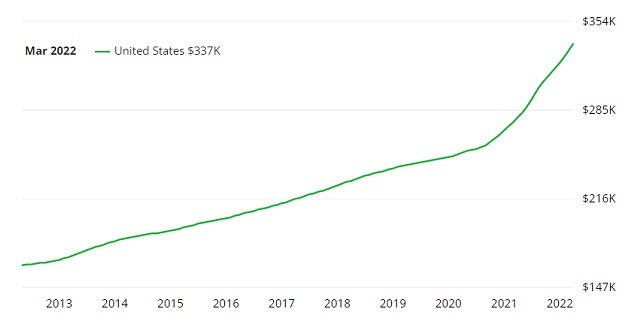

The number of homes for sale was down 309 from the previous quarter and down 56 from the same period a year ago. Utah Home Sales Year over year sales rose in four of the seven counties contained in this report but fell in the balance of the region. This pace of double-digit price appreciation in the housing market is unsustainable.

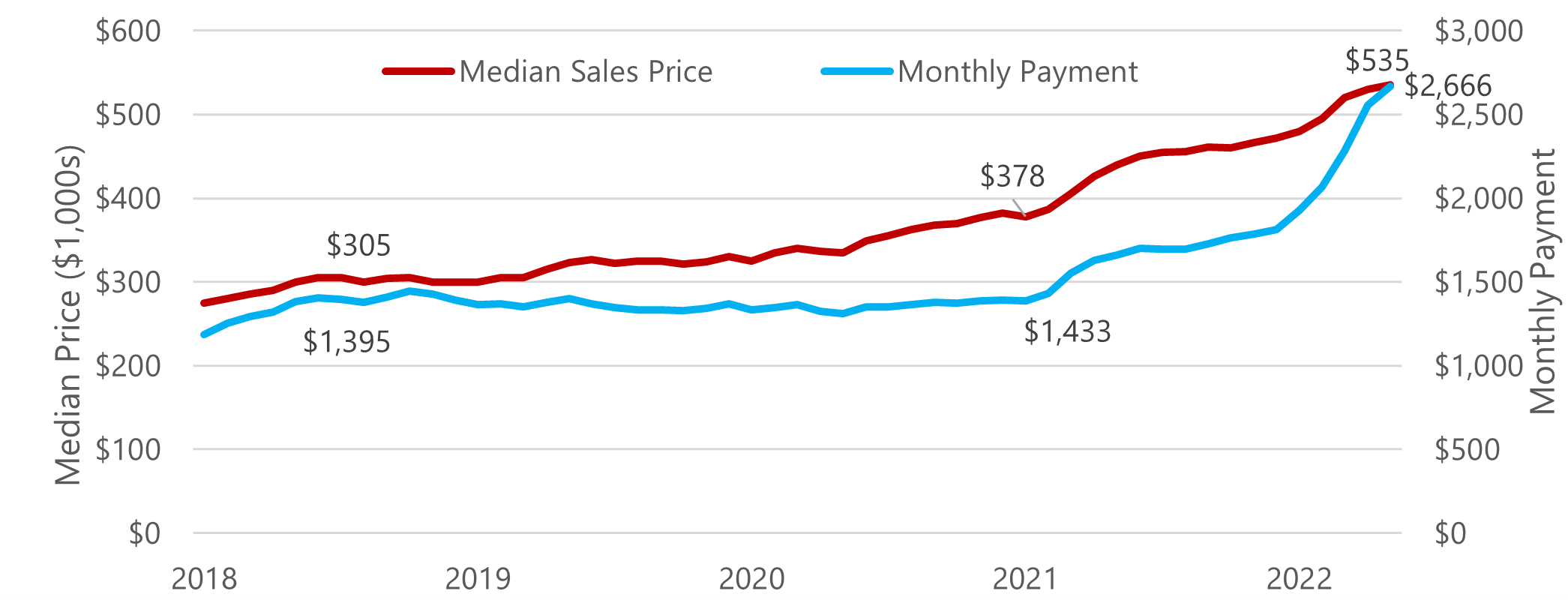

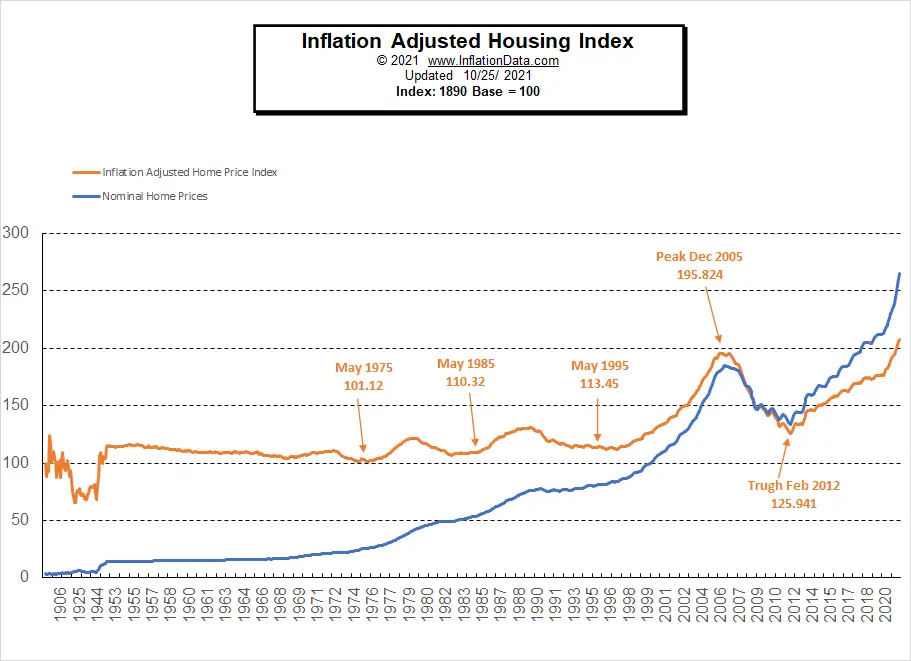

Wood who has been tracking housing in Utah since the 1970s presents a market forecast each year. Instead I think home prices will rise by closer to 8 in 2022 not 16 like it did in 2021. 15 One huge glaring reason for that historic low was the governments temporary ban on foreclosures as a pandemic relief measure.

Top Five Factors That Could Cause a 2023 Housing Market Crash. In Utah County the price is even bigger the largest of all of Utahs five Wasatch Front counties. The forbearance and foreclosure protections extended by the federal government have artificially restricted housing supply.

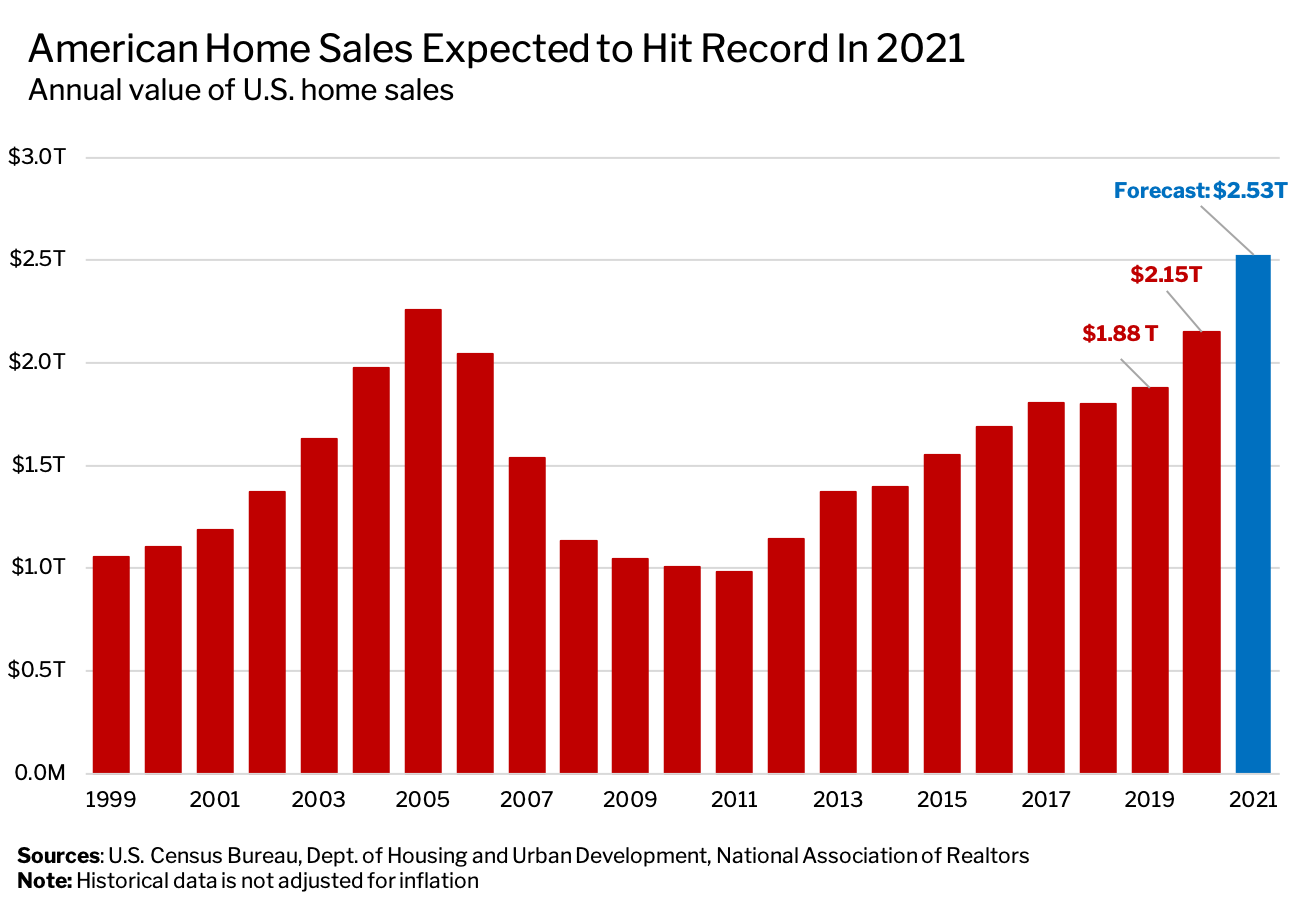

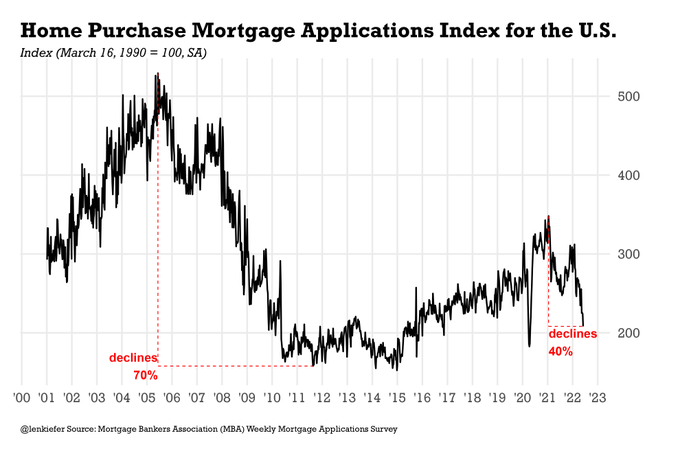

Region-wide 5611 single-family homes changed hands in the first three months of 2021 451 fewer than those same months the year prior. In fact foreclosures hit an all-time low in 2021 down 30 from 2020 and 95 from its peak in 2010 during the housing market crisis. That unprecedented growth is expected to have an even larger impact on housing in communitiesand those trends of the future are already starting to show up today.

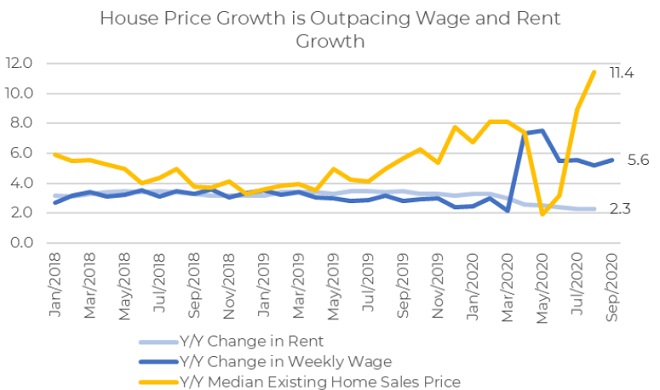

For example if a home is valued at 150000 a landlord could charge anywhere from 1000 to 1750 for rent each month. In January Utah real estate prices leveled out from their previous upward trend. Inflation will remain higher than the Federal Reserves target of 2.

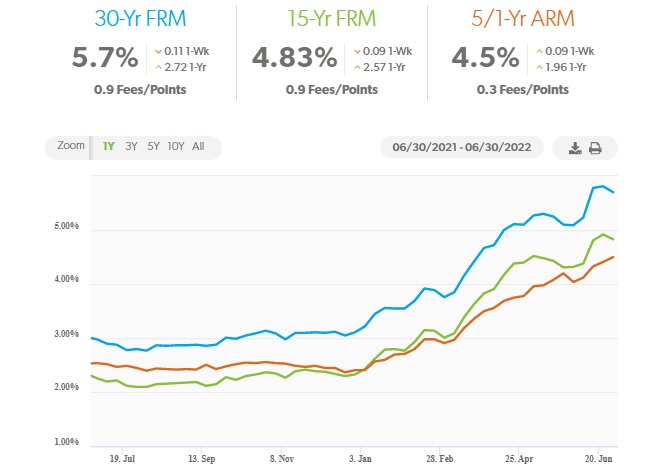

There the median single-family home price climbed to. He said over the last five years home prices have. Mortgage rates will be over 6.

The market is just a reflection of the population and their job and financial health. But people said the same things before the last crash right. When the price of homes increases the rent price inevitably increases as well.

Though people in the industry are quick to point out the differences. However while parts of the country were on a slow rise to recovery Salt Lake made upward movement faster than other areas and returned to the same prices as before 2008. As long as supply chains are constrained and buyer demand is high home prices in the Utah housing market will likely keep going up through 2022 and possibly following years.

Median home prices settled at 380K down 4K or 1 from December. If inflation rises there will be less consumer spending leading to an economic downturn economic instability and a possible recession. Mark Zandi the chief economist of Moodys Analytics said he is concerned about a harsh landing in the housing market but he believes the market and economy will not collapse as they did last time.

The Federal Reserve will try to fight inflation by raising rates at least 3 times. Lets go over some more details on why the housing market has some signs of concerns. Even though prices are high buying a home can still be a good investment as real estate prices will keep going up.

The annual trend however shows a stark contrast. In Salt Lake County the median price of a single-family home hit 580000 in February up over 236 from 469000 at the same time last year according to the Salt Lake Board of Realtors. Rapid population and job growth are the biggest drivers of housing demand in Utah right now.

This will certainly boost the chances of a 2023 crash. Utah is projected to double its population by 2065. Median home prices rose 55K or 169 from the previous January.

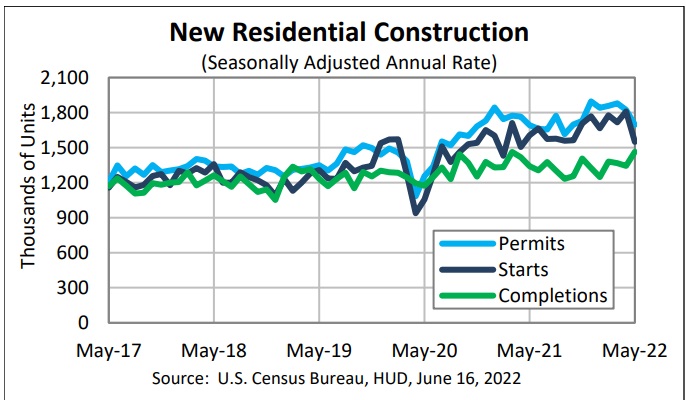

Housing supply is reaching all-time lows and demand remains high. There is no reason to believe that the housing market will crash like it did in 2008. Average sales prices meanwhile vaulted by between 17 and.

He believes that for the 2023 housing market home prices will level off decreasing in certain sections of the country while rising somewhat in others. There is fear that this upward trend is destined to develop into something reminiscent of the monster housing market demise and economic crash of 2008. After all most landlords determine rental prices by charging a small percentage of their homes overall value.

Inventory levels remain well below the average which is clearly limiting sales. Pending sales which are an indicator of. The 2020-21 trendline has been mirroring the 2019-20 trendline for several.

U S Home Sales Likely To Hit Record 2 5 Trillion In 2021 Redfin Predicts

Real Estate Housing Market Crash Housing Bubble Factors Signals Predictions

Real Estate Housing Market Crash Housing Bubble Factors Signals Predictions

Blog Where Does Utah S Housing Market Go From Here Kem C Gardner Policy Institute

The Us Housing Market Is Heading Toward The Most Significant Contraction Since 2006 Ksl Com

Average New Home Sales Price In The U S 2021 Statista

Will The Housing Market Crash In 2022 Utah Facing Imbalance But No Bubble Deseret News

Real Estate Housing Market Crash Housing Bubble Factors Signals Predictions

Investing Stocks Or Real Estate Firsttuesday Journal

A Look Back At Washington County S Housing Bubble Kem C Gardner Policy Institute

Real Estate Housing Market Crash Housing Bubble Factors Signals Predictions

Inflation Adjusted Housing Prices

Housing Bubble Getting Ready To Pop Mortgage Applications To Purchase A Home Drop To Lockdown Lows Bad Time To Buy Hits Record Amid Sky High Prices Spiking Mortgage Rates Wolf Street

Realtor Com Forecasts The Top Housing Markets Of 2022

What Home Prices Will Look Like In 2023 According To Zillow S Revised Downward Forecast